Franchising can be a fantastic way to start your own business, but not every opportunity is what it seems to be. Although the industry is highly regulated, there are still key considerations to be aware of. As a franchise consultant with decades of experience, I help people spot both the risks and the gems.

Franchise buyer beware: some warning signs are easy to miss if you’re new to the process. Vague sales language can conceal real challenges, and unclear financial information may indicate issues with the franchisor. High turnover among franchisees is another red flag that often points to deeper issues you want to avoid.

Pressure tactics and hidden fees can make decisions feel rushed and confusing. Understanding these red flags helps you make smarter choices and protect your investment. With the proper guidance, you can find a franchise that genuinely fits your goals and sets you up for long-term success.

Top Red Flags to Spot Before Buying a FranchiseKey Takeaways

- Look for vague promises and buzzwords that can mask operational challenges and the experiences of franchisees.

- Ensure financial data is transparent; audited statements are crucial for assessing the franchisor’s health.

- High franchisee turnover rates signal potential instability and operational issues within the franchise system.

- Be wary of high-pressure tactics that rush decision-making and limit thorough due diligence.

- Scrutinize franchise fees for transparency; unclear structures may hide additional costs or overpricing.

Vague or Overly Polished Sales Language

How can vague or overly polished sales language obscure the true nature of a franchise opportunity? Often laden with vague promises, such language employs buzzwords and heartfelt appeals that may create an illusion of professionalism. While such presentations can be alluring, they usually distract potential buyers from critical inquiries about operational challenges and franchisee experiences. The reliance on superlatives and ambiguous claims about growth potential can lead to inflated expectations, fostering passionate decision-making rather than informed assessments.

Without specific, quantifiable performance metrics, prospective franchisees may struggle to accurately evaluate the actual viability of a franchise, leaving them vulnerable to potential financial losses. By prioritizing transparency and concrete evidence, buyers can navigate these red flags and seek opportunities that authentically align with their aspirations and values. Additionally, it is crucial to thoroughly review the Franchise Disclosure Document (FDD), as it provides essential details about the franchisor’s history, operations, and obligations to franchisees.

Understanding the financial commitments involved is crucial for avoiding common pitfalls that stem from unrealistic expectations.

Lack of Transparent Financial Data

While the allure of franchise ownership can be compelling, a lack of transparent financial data often raises significant concerns for prospective buyers. Audited statements are vital for evaluating a franchisor’s financial health, and any absence may signal potential risks. Buyers should be wary of:

- Omissions in delivering audited financial statements.

- Financial reports are lacking CPA audit approval, indicating insufficient verification.

- Simplified data presentations that obscure actual financial conditions.

- Reliance on internal, unaudited reports rather than thorough disclosures.

- Refusal to provide supplementary financial insights about specific locations.

Such financial discrepancies can mask underlying instability, making it necessary for buyers to demand clarity and adherence to regulatory requirements before making commitments. Transparency is key to informed decision-making in franchise investments. Furthermore, prospective buyers should ensure that the franchisor provides three years of audited financial statements, as this is crucial for evaluating the franchisor’s long-term viability.

Additionally, structured frameworks for succession planning can help in assessing the overall economic stability of a franchise system.

High Franchisee Turnover and Closures

High franchisee turnover and closures pose significant challenges within the franchising landscape, revealing underlying operational instability and market pressures. High turnover rates often result from persistent operational challenges, such as labor shortages and rising costs, leading to negative cash flow for franchisees. When units are unable to perform, franchisees may close underperforming locations to sustain overall viability.

This dynamic underscores the crucial importance of robust franchisee support; inadequate guidance can exacerbate financial strain and increase the risk of franchise closure. Industries like food service and individual services experience heightened turnover due to these factors. Ultimately, a franchise’s operational efficiency and support systems play a pivotal role in mitigating turnover and ensuring the lasting success of its franchisees in an increasingly competitive environment.

Notably, the franchise sector is projected to add approximately 210,000 jobs in 2025, indicating potential growth opportunities amidst these challenges. Furthermore, understanding the franchisor’s support system is essential for franchisees in navigating these turbulent times.

Pressure to Make Quick Decisions

What drives potential franchisees to rush their decisions? High-pressure tactics employed by franchisors can create an environment rife with decision-making stress. The urgency to act quickly can cloud judgment, leading to hasty commitments that overlook crucial details.

High-pressure tactics by franchisors can lead to rushed decisions, clouding judgment and risking long-term success.

- Imposed deadlines limit thorough due diligence.

- Limited-time offers induce an artificial sense of urgency.

- Frequent contact can foster a fear of missing out.

- Avoidance of outside advice raises red flags.

- Push for non-refundable deposits compels immediate action.

Such pressures often result in overlooked costs, inadequate understanding of support, and unrealistic expectations. Additionally, failure to assess the success rate can lead to misguided investment decisions. Ultimately, haste can jeopardize the long-term success of the franchise, making it critical for buyers to resist the urge to rush and prioritize informed decision-making.

Furthermore, understanding demographic profiling can provide valuable insights into the franchise market, helping potential franchisees make more informed choices.

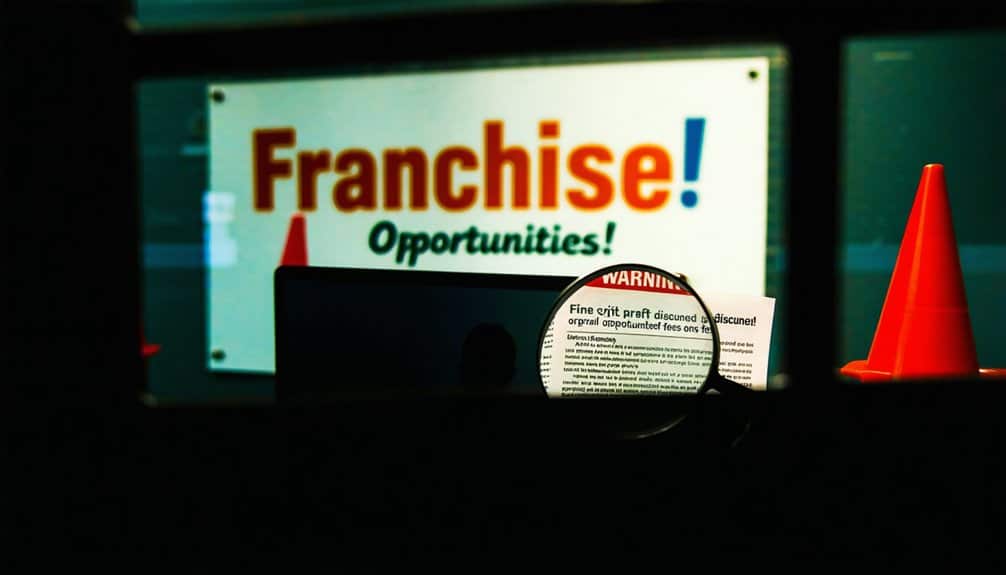

Unreasonable or Discounted Franchise Fees

When evaluating franchise opportunities, unreasonable or discounted franchise fees can serve as a critical warning sign for potential investors. Excessive initial fees often lack proper justification, indicating potential overpricing or inadequate value, which can hinder profitability. A transparent fee structure is essential; ambiguity can mask hidden costs that affect total investment clarity.

Additionally, the presence of missing financial performance data can further complicate the assessment of whether the fees are justified. It is also essential to consider the ongoing support from the franchisor, as this can significantly influence the overall success of the franchise.

| Fee Type | Considerations |

|---|---|

| Initial Franchise Fees | Compare against industry averages for justification |

| Ongoing Royalties | Evaluate their impact on profit margins |

| Hidden Costs | Look for clear itemization of fees |

| Franchisee Support | Assess the correlation between fees and support |

Investors must conduct thorough franchise fee comparisons and seek clarity to guarantee alignment with sustainable business practices.

Frequently Asked Questions

Franchise buyer beware: what financial red flags should I watch for?

Look closely at inconsistent or unclear revenue projections and unusually high initial fees that don’t match industry standards. These financial warning signs often indicate a franchisor that may not be well-suited for long-term success.

How Can I Assess a Franchisor’s Overall Reputation?

To assess a franchisor’s comprehensive reputation, one must analyze franchisee testimonials, scrutinize online reviews, and evaluate marketing consistency. This multifaceted approach reveals strengths and weaknesses, fostering informed decisions for prospective franchisees who seek a sense of belonging in a supportive network.

What Resources Are Available for Franchisee Reviews and Experiences?

Like a lighthouse guiding ships, franchisee testimonials and online forums illuminate valuable insights into franchise experiences. These resources offer aspiring buyers genuine perspectives, fostering a sense of belonging and informed decision-making throughout their entrepreneurial journey.

How Do I Find Legal Assistance for Franchise Agreements?

To find legal assistance for franchise agreements, individuals should investigate legal consultation options and seek recommendations from franchise attorneys. Prioritize experts with specific experience in franchise law, ensuring thorough support throughout the franchise lifecycle and effective dispute resolution.

What Are Common Franchise Pitfalls to Avoid?

Common franchise pitfalls include overlooking hidden franchise fees and underestimating costs associated with training programs. Vigilant analysis of financial obligations and a thorough understanding of training requirements are crucial for ensuring long-term success and economic viability in franchising.

How Can I Prepare for Potential Franchise Disputes?

In the intricate dance of franchising, preparing for potential disputes means establishing clear dispute resolution strategies. Embracing franchise mediation and open communication creates a harmonious atmosphere, fostering collaboration and minimizing conflicts before they escalate into costly battles.

Conclusion

Buying a franchise can be one of the best choices you ever make, but it’s essential to be cautious. Not every franchise tells the whole story, and some hide details that could cost you time and money. By learning what to watch for, you take control of your future.

Franchise buyer beware: vague promises, hidden fees, and rushed decisions are all warning signs. High turnover or unclear financial information can also indicate more significant issues behind the scenes. Recognizing these red flags helps you make more informed choices.

The good news is, you don’t have to figure it out alone. With the proper guidance, you can find a franchise that fits your goals and sets you up for success. If you have any questions, please don’t hesitate to contact us at your convenience. It’s always free, and we’ll do our best to help.

References

- https://franzy.com/blog/can-you-lose-money-buying-a-franchise/

- https://www.allbusiness.com/red-flags-to-watch-for-when-buying-a-franchise-15587164-1.html

- https://www.ifpg.org/buying-a-franchise/red-flags-to-watch-out-for-in-a-franchise-opportunity

- https://blog.franchisee.ai/franchise-problem-solving/how-to-identify-the-red-flags-in-franchise-opportunities/

- https://www.vikingmergers.com/blog/8-red-flags-to-avoid-when-buying-a-franchise/

- https://e2visafranchises.com/franchise-red-flag-top-10-red-flags/

- https://www.entrepreneur.com/franchises/the-top-discovery-day-red-flags/488532

- https://mooreeng.com/2024/06/18/be-wary-of-franchises-can-we-franchise-safety/

- https://www.franchisehelp.com/franchisee-resource-center/how-to-read-the-franchise-disclosure-document-and-red-flags-to-look-for/

- https://www.franchiselawsolutions.com/learn/franchise-compliance/financial-statement-disclosure-requirements