A strong credit score is essential for any business owner, as it affects their ability to secure loans and other financing. In fact, according to a recent survey of small business owners, more than 80% reported that having a positive credit history was necessary for the success of their businesses. This article examines the importance of personal credit scores for business owners and provides practical advice on building and managing credit successfully. From understanding the impact of individual credit scores on business ownership to learning how to read a credit report and increasing your score, this article will provide valuable insight into managing finances responsibly.

Key Takeaways: Personal Credit Scores and Business FinancingKey Takeaways

- A strong credit score is essential for business owners to secure loans and financing.

- Personal credit scores are numerical representations of creditworthiness and are used by lenders to assess financial responsibility.

- Bad credit scores can hinder access to necessary loans and capital for starting a business, while good credit scores increase the chances of loan approval.

- Building credit for business owners involves timely payments, reducing personal debt, using credit responsibly, and seeking professional help to manage debt and build a solid credit history.

What Are Personal Credit Scores?

Personal credit scores are numerical representations of an individual’s overall creditworthiness. It is a way to monitor risks and other factors related to their financial obligations. Credit scores have become an essential part of modern life for anyone seeking a loan, renting property, or applying for specific jobs. Credit scores are calculated using complex algorithms that factor in data from past loans, lines of credit, and other financial activities. Financial literacy is the key to understanding how these ratings are calculated and what steps can be taken to improve one’s score. Knowing the basics about personal credit scores, including what information has been used to generate them, their importance in financing decisions, and how they impact other financial services, can give individuals the power they need when making responsible financial decisions.

Personal credit scores are numerical representations of an individual’s overall creditworthiness. It is a way to monitor risks and other factors related to their financial obligations. Credit scores have become an essential part of modern life for anyone seeking a loan, renting property, or applying for specific jobs. Credit scores are calculated using complex algorithms that factor in data from past loans, lines of credit, and other financial activities. Financial literacy is the key to understanding how these ratings are calculated and what steps can be taken to improve one’s score. Knowing the basics about personal credit scores, including what information has been used to generate them, their importance in financing decisions, and how they impact other financial services, can give individuals the power they need when making responsible financial decisions.

The Impact of Credit Scores on Business Ownership

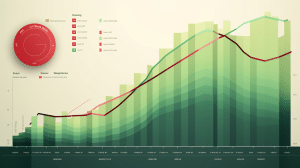

The impact of financial data on potential business ownership is significant. Understanding a person’s credit score is paramount when making informed decisions about their ability and eligibility for financing. Credit scores can range from 300 to 850 and are used by lenders to indicate the borrower’s responsibility in managing personal finances. A good credit score signals that someone is reliable, while a bad one implies they are unreliable or irresponsible with money. This can have severe implications for those looking to start a business, as it could mean not being approved for the necessary loans and capital needed to get started.

to 850 and are used by lenders to indicate the borrower’s responsibility in managing personal finances. A good credit score signals that someone is reliable, while a bad one implies they are unreliable or irresponsible with money. This can have severe implications for those looking to start a business, as it could mean not being approved for the necessary loans and capital needed to get started.

Fortunately, debt consolidation or credit repair services can help business owners improve their credit scores before seeking funding for their venture. Debt consolidation involves consolidating multiple debts into one loan with more favorable terms, such as lower interest rates and better repayment schedules. Credit repair services generally involve challenging errors on credit reports that may be causing someone’s score to suffer unfairly. With improved financials, business owners can go from red flags to green lights in the eyes of lenders and investors alike. This way, personal credit scores can make or break a budding entrepreneur’s dreams of owning a successful business enterprise.

Building Credit for Business Owners

Establishing and improving credit scores are essential for business owners. Credit scores are crucial in how lenders view businesses, so taking steps to build or improve them is important. Business owners can do this through various strategies such as making timely payments, reducing personal debt, and using credit responsibly.

Establishing Credit

Achieving a desirable credit score requires developing a history of responsible borrowing. Establishing credit is the first step in building personal or business credit, and managing debt is critical to achieving long-term financial success. It involves understanding your financial situation and creating a plan to pay off debts. Additionally, it’s essential to maintain consistency when making timely payments and only take out necessary loans that fit within your budget. Financial institutions will use this information to assess an individual’s creditworthiness before granting access to additional types of borrowing, such as lines of credit or mortgages. By establishing responsible habits early on, individuals can work towards creating a positive credit history and ultimately achieve their desired score.

Improving Score

A solid credit score can be achieved by taking proactive steps to improve it. Business owners can access capital, secure low-interest loans, and take advantage of other financial perks that come with an excellent score. To do so, they should focus on:

- Strategically Managing Debt:

- Pay bills on time * Reduce credit utilization

- Consider consolidating debt

- Building Credit History:

- Open new accounts and use them responsibly

- Obtain a secured credit card if necessary

- Monitor your credit report regularly for accuracy

- Seeking Professional Help:

- Consult reputable organizations for guidance and advice on managing debt and building a strong credit history.

These steps will help business owners reach their financial goals while providing greater access to capital.

Tips for Managing Credit Cards

Using credit cards responsibly can benefit business owners when managing their credit scores. Developing a budget and creating a plan to pay off charges in full each month can help build a positive payment history, which is the most significant factor influencing an individual’s score. It is also important to avoid charging more than 30% of the credit limit on any card, as this will hurt one’s score.

Business owners should also consider setting up automated payments for recurring expenses so that they never miss due dates; late payments are particularly damaging to a personal credit score. Additionally, if multiple cards are used, it is wise to distribute charges across them, as close attention should be paid to ensuring that balances remain low relative to the limits of each card.

How to Read a Credit Report

Examining credit reports and analyzing scores are essential for business owners, as they are important indicators of financial health. A credit report contains a wealth of information about an individual’s past payment history, current debt levels, and other factors that can influence their ability to obtain loans or secure credit lines in the future. Understanding how to read a credit report is therefore crucial for any business owner looking to manage their finances responsibly. By understanding the details listed on a credit report, one can gain insight into an individual’s overall financial picture and make decisions regarding their financial management accordingly.

Examining Reports

Analyzing reports is a critical factor in understanding personal credit scores for business owners. Credit utilization, debt consolidation, and other factors should be considered when evaluating information. There are four main aspects of analyzing a credit report:

1) Reviewing the amount of debt;

2) Identifying any derogatory marks;

3) Analyzing payment history;

4) Examining credit inquiries.

These elements provide insight into how lenders view the individual’s financial situation, which can either raise red flags or give a green light to the person’s loan application. Knowing what information is included in a credit report helps business owners develop strategies for improving their scores and increasing their chances of securing financing.

Analyzing Scores

Assessing credit scores is an essential step in determining the potential of a loan for business owners. Credit utilization and debt consolidation are key components in analyzing personal credit scores. Credit utilization looks at the amount of credit used compared to the amount available, while debt consolidation considers all outstanding debts. Low debt and unused available credit can help bolster a credit score, while higher levels may result in a lower rating. Factors such as late or missed payments can drastically reduce one’s score. By understanding these considerations, business owners can take steps to ensure that their credit score accurately reflects their financial health.

How to Dispute Errors on a Credit Report

Investigating errors on a credit report is an essential step for business owners to improve their credit scores. This involves monitoring credit habits, creating payment plans, and promptly disputing mistakes. Business owners need to understand the process of fighting errors on a credit report to improve their financial standing:

- Obtain a copy of your credit report by visiting AnnualCreditReport.com or contacting one of the three major consumer reporting agencies: Equifax, Experian, and TransUnion.

- Review the information carefully and note any discrepancies or inaccuracies that you may find.

- Contact the reporting agency where the mistake occurred and explain why it should be changed or removed from your record. Provide supporting evidence if needed, such as bills or statements proving that you have paid off a debt in full or other documents demonstrating that the incorrect account belongs to someone else.

Disputing errors can take some time but ultimately has tremendous potential to positively impact one’s financial situation by dramatically improving one’s credit score – providing more opportunities for business owners to obtain financing when needed.

Benefits of Good Credit for Business Owners

A good credit score is essential for businesses, as it can affect the rates they pay for borrowing money and their eligibility to obtain loans. Credit utilization, debt consolidation, and other factors are considered when determining an individual’s credit score. Businesses with excellent credit scores may have access to more opportunities and lower interest rates than those with bad or poor scores. This allows them to take advantage of better deals from lenders and be more competitive in terms of price and quality of services. Additionally, having a good credit score makes it easier for business owners to apply for additional funding when needed.

Good credit also helps businesses secure better lines of credit, allowing them to make larger purchases without worrying about taking on too much debt at once. Furthermore, it can open up new possibilities, such as long-term financing options or even starting new ventures with confidence in the ability to borrow funds if needed. Lastly, potential customers may be more likely to do business with companies with a proven track record of responsible management of finances through good credit ratings. In summary, having an excellent personal credit score benefits business owners on many levels, from increased access to capital and lower interest rates to improved customer trustworthiness.

How to Increase Your Credit Score

Improving one’s credit score can benefit personal and business-related objectives. Debt consolidation is a popular choice to help raise a credit score. Consolidating debt involves taking out a loan with a low-interest rate and using the funds to pay off high-interest debts, such as credit card balances. This strategy helps borrowers pay off their debt faster, reduce the stress of managing multiple payments each month, and improve their credit scores by reducing the amount of outstanding debt they owe.

Another way to increase one’s credit score is to manage their credit utilization ratio. Credit utilization is the percentage of available revolving credit used; it is calculated by dividing the total balance owed on all accounts by authentic available revolving limits. Keeping this ratio below 30 percent will demonstrate responsible use of borrowing power and reflect positively on your overall credit score.

Credit Monitoring Services for Business Owners

Monitoring businesses’ credit can provide insight into financial health and potential risks. Business owners should consider enrolling in a credit monitoring service to keep track of their business’s credit history, score, and utilization. Credit monitoring services often alert customers when there are:

- Changes to their credit scores or report

- Signs of identity theft

- Unusual activity on their accounts

Credit monitoring services provide business owners with peace of mind as they can quickly react to any changes in their credit status. This is especially important for entrepreneurs since a business loan could be challenging to obtain if there is an issue with the owner’s credit score. A credit monitoring service also allows the business owner to monitor their total utilization ratio, calculated by dividing total outstanding balances by the total available balance. Understanding this ratio helps ensure that loans are manageable and not too risky for lenders. In summary, accessing detailed information about one’s personal and business credits through a reliable service can be invaluable for any entrepreneur looking to start or grow their venture.

Frequently Asked Questions

What Are the Average Credit Scores of Successful Business Owners?

Successful business owners typically have credit scores that fall within certain thresholds. Generally, a score of 700 or higher is considered good and can positively impact the ability to access resources needed for success. A score below 600 may be regarded as bad credit, leading to difficulties completing transactions necessary for business operations. Credit scores are important indicators of financial health, and a good one is essential for successful business owners.

Are There Additional Risks Associated With Bad Credit for Business Owners?

Having a bad credit history can present additional risks for business owners. Poor financial planning can lead to decreased access to capital, higher loan rates, and lower lines of credit. This can make it difficult for businesses to invest in growth opportunities or cover unexpected expenses. Low credit scores are also a red flag to potential investors, who may hesitate to partner with someone with high financial risk. Business owners need to manage their credit history and create an accurate and positive representation of their finances.

How Does a Business Owner’s Credit Score Affect Their Ability to Obtain Financing?

A business owner’s credit score can be likened to a light switch – when it is good, financing is easily obtained. However, securing funding becomes increasingly difficult if the light switch turns red. Analyzing the impact of a poor credit score on the ability to get funding should be done carefully and precisely. With appropriate measures like credit repair and financial literacy, this red flag may eventually become a green light for potential lenders. Thus, understanding one’s credit score is essential for any business owner seeking access to capital.

Is There a Difference Between Personal and Business Credit Scores?

Yes, there is a difference between personal and business credit scores. Personal credit scores are based on payment history, debt levels, and the length of an individual’s credit history. Business credit scores are more related to the financial stability of a company and, therefore, take into account factors such as revenue trends, cash flow, and credit utilization. Businesses have access to additional sources of financing that are not available to individuals. As such, their creditworthiness is determined by different metrics than those used for personal credit scoring.

How Often Should Business Owners Check Their Credit Score?

Business owners should proactively monitor their credit score, an essential factor in business operations. Credit utilization should be checked regularly to ensure that the overall ratio does not exceed 30%. Credit monitoring services can also help business owners stay informed on changes to their scores and associated factors. This will provide them with insight into the financial health of their business and enable them to make better decisions concerning loans or investments. Monitoring credit scores is an essential part of responsible business ownership.

Conclusion

The importance of personal credit scores cannot be overstated when it comes to business ownership. Good credit can open the door to many financial opportunities, while bad credit can lead to severe consequences. However, business owners can learn to monitor and manage their credit scores responsibly and effectively with simple steps. By understanding the implications of their credit scores and utilizing available resources wisely, business owners can build solid foundations for success by turning red flags into green lights.