Who is a franchisee? A straightforward definition and the responsibilities that come with ownership

A franchisee is an independent business owner who buys the right to use a franchisor’s brand, systems, and operating model. In short, you run a local business while following a proven playbook. That setup blends hands-on entrepreneurship with tested processes, which can lower startup risk and speed market entry. Knowing what a franchisee does makes it clear who pays for what, who enforces the brand rules, and which day-to-day tasks keep customers coming back. This guide defines franchisee types, outlines core duties—financial management, operations, compliance, team leadership, and local marketing—and provides practical frameworks for assessing readiness. If you’re ready to explore options, Business Builders can connect you with vetted opportunities and help clarify the financial and operational requirements you’ll face. Below, we cover franchisee types, key responsibilities, compliance and brand stewardship, leadership and customer relations, the pros and cons of franchising, and how Business Builders supports the process.

What is a Franchisee? Clear definition and essential traits

A franchisee runs a business under a franchisor’s brand and systems, paying for the right to use trademarks, processes, and support in exchange for fees and royalties. That arrangement lets an owner lean on an established model and training while staying responsible for local execution. Franchisees range from single-unit operators focused on a single location to master franchisees who control larger territories and assume development obligations. Knowing those differences helps you match your ambition, capital, and operational capacity to the correct franchise structure—and understand the balance between independence and system compliance.

Key characteristics that set franchisees apart:

- Operates under a brand: You deliver products or services using the franchisor’s name, trademarks, and customer promise.

- Pays fees and royalties: Expect an initial franchise fee plus ongoing royalties, often a percentage of sales.

- Follows systems and manuals: Day-to-day operations follow the franchisor’s procedures—from recipes to customer scripts.

These traits distinguish a franchisee from other business owners. Next, we’ll compare the franchisee’s role with the franchisor’s to clarify responsibilities and decision-making authority.

How does a franchisee differ from a franchisor?

A franchisee operates and manages a local unit. A franchisor builds the system — the brand, the playbook, the training, and marketing strategy — that franchisees implement. The franchisor sets standards and central policies; the franchisee applies those rules locally, adapts within allowed limits, and delivers the customer experience. Financially, franchisors collect initial fees and royalties, while franchisees cover local capital, payroll, and operating costs. Legally, the franchise agreement spells out who does what—understanding that a split helps you see where you’ll make decisions and where the franchisor retains control.

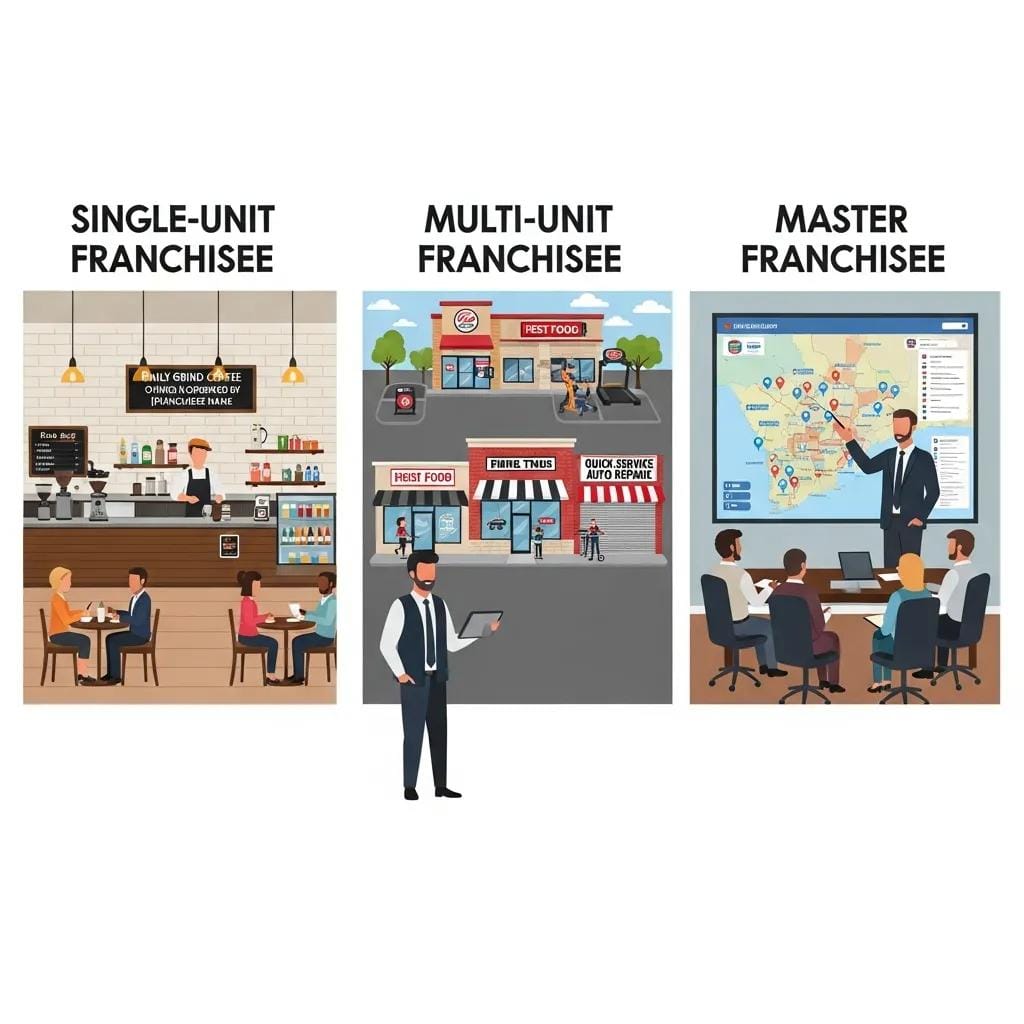

What are the main types of franchisees?

Franchisee types differ by scale, required investment, and strategic goals. Common models include:

- Single-unit franchisee — Invests personal capital and runs one location. Suitable for first-time owners who want hands-on control.

- Multi-unit franchisee — Owns several locations, benefits from economies of scale, and often centralizes management. Fits more experienced operators or investors.

- Area developer/master franchisee — Commits to developing multiple units across a region; master franchisees may sub-franchise. These roles need more capital, planning, and project management.

Choosing the right subtype means aligning your capital, appetite for complexity, and growth goals with the franchise opportunity.

What are the primary responsibilities and duties of a franchisee?

Franchisee responsibilities fall into five core areas: financial stewardship, operational management, brand and system compliance, human resources, and local marketing. Financial stewardship covers the initial fee, royalties, advertising contributions, and the maintenance of working capital. Operational management is the day-to-day work: opening and closing, inventory management, vendor relations, quality checks, and performance tracking. Brand compliance, HR, and local marketing complete the picture: follow the operations manual, train your team, and run approved local campaigns. The sections below break down financial commitments and everyday tasks so you can assess readiness and plan effectively.

Top duties to prioritize as a new owner:

- Financial management and reporting: Budgeting, paying royalties, and meeting tax rules.

- Operational execution: Using checklists, controlling inventory, and upholding quality.

- Brand and legal compliance: Following the operations manual, signage rules, and franchisor policies.

- Team leadership: Hiring, training, and keeping staff who represent the brand.

- Local marketing and customer acquisition: Running approved local campaigns to drive traffic and loyalty.

These responsibilities are the backbone of a successful location. Business Builders offers guidance and resources to help candidates evaluate financial and operations readiness and find franchise concepts that fit.

How does a franchisee manage financial commitments and obligations?

Start by mapping the payments you’ll owe: the initial franchise fee, ongoing royalties, advertising contributions, and enough working capital to cover startup and early months. Build a disciplined budget and cash-flow forecast with conservative revenue assumptions and a reserve for the first months. Track royalty and marketing remittances separately and reconcile sales regularly. Many franchisees use accounting software tied to point-of-sale systems to automate reporting and simplify royalty calculations, and they produce monthly management reports to guide decisions. A realistic financial plan and adequate reserves reduce liquidity risks and help you stay compliant with franchisor requirements.

What operational management tasks does a franchisee perform daily?

Daily operations turn the franchisor’s system into a reliable customer experience. Typical tasks include opening and closing routines, staff briefings, inventory counts and ordering, quality checks, cash reconciliations, and performance dashboard reviews. You’ll manage suppliers, confirm deliveries, and quickly resolve bottlenecks to protect uptime and customer satisfaction. Use a short daily and weekly checklist tied to key metrics—sales per hour, average ticket, and customer feedback—to keep the location accountable and improving.

A simple daily checklist for new owners:

- Open/close procedures: Verify safety, cash handling, and readiness.

- Inventory & ordering: Prevent stockouts and control costs.

- Customer experience checks: Confirm service standards and cleanliness.

These operational controls affect revenue and reputation. Next, we explain how franchisees maintain brand consistency and remain compliant.

How does a franchisee uphold brand standards and compliance?

Franchisees maintain brand consistency by following the franchisor’s operations manual, adhering to marketing and signage rules, participating in audits, and documenting corrective actions when needed. The operations manual is your primary guide for product quality, presentation, customer service, and back-office processes. Marketing rules define what local ads and promotions look like and how approvals work, allowing limited local adaptation without risking the brand. Regular audits—scheduled or surprise—plus self-assessments and refresher training create a continuous compliance loop that protects the system and builds customer trust.

Before practical steps, a short checklist to guide action:

- Understand the operations manual: Learn mandatory processes and performance standards.

- Follow marketing approval processes: Submit local ads for review when required.

- Participate in audits and training; implement corrective actions to maintain high standards.

Following these steps lowers compliance risk and improves local results. The following section dives into marketing responsibilities and examples of permitted versus prohibited local tactics.

What are the franchisee’s obligations regarding marketing and brand reputation?

Franchisees usually contribute to national or regional marketing funds and run local campaigns that follow franchisor rules. Obligations can include minimum ad spend, creative approvals, participation in system-wide promotions, and the use of approved assets only. For reputation management, franchisees monitor reviews, respond within franchisor guidelines, and build community relationships that align with the brand. Permitted local marketing might include community sponsorships using approved logos; prohibited actions often involve unapproved branding, unauthorized discounting, or unsupported product claims.

I’d like you to work practical tips into your local marketing: use franchisor templates, document approvals, and track campaign ROI to show value and refine future spending. Those practices support compliance while driving local customer growth.

How does a franchisee ensure adherence to the franchisor’s operational guidelines?

Adherence comes from structured training, routine self-audits, working with franchisor support, and keeping clear corrective-action records when gaps appear. Schedule regular refresher training, keep checklists aligned with the manual, and monitor compliance metrics such as mystery-shop scores and health audits. When issues arise, follow a straightforward corrective process: identify, document, plan, implement, and verify. Lean on franchisor field visits and training tools to reinforce consistent execution and reduce repeat problems.

Strong operational discipline protects your store’s reputation and the wider brand. That links directly to hiring, training, and keeping a capable team.

What are the franchisee’s roles in team leadership and customer relations?

As a franchisee, you recruit staff who fit the brand, run structured onboarding and ongoing training, and manage performance with clear metrics and feedback so customers get a consistent experience. Hiring starts with role-based job descriptions that reflect brand values. Onboarding should follow a timeline—orientation, shadowing, competency checks, and formal sign-off—using franchisor training where available. Ongoing coaching, short refresher sessions, and KPI-driven reviews help retain talent and maintain standards. These people practices support loyalty-building through reliable service and effective recovery when issues occur.

Franchisees also drive customer loyalty with strong service, consistent recovery protocols, and local engagement that turns first-time buyers into repeat customers. The following sections offer recruiting tactics and loyalty strategies.

How does a franchisee recruit, train, and manage employees?

Start with clear job descriptions, screening criteria, and interview questions that match the brand’s service standards. Onboarding should be a phased schedule—orientation, shadowing, skills checks, and sign-off—using franchisor modules when available. Ongoing development includes short refreshers, coaching, and metric-based feedback. Retention tools such as recognition programs and defined career paths help retain good people. Performance management relies on regular reviews tied to KPIs—customer satisfaction, sales per labor hour, and task completion—to drive steady improvement.

This approach builds a dependable team that delivers consistent customer experiences and supports loyalty programs.

What strategies do franchisees use to build customer loyalty and service quality?

Franchisees build loyalty by enrolling customers in system-wide programs, delivering consistent service, and participating in community activities that reinforce the brand.

- Enroll customers in the franchisor’s loyalty program

- Use consistent service-recovery steps to resolve complaints quickly

- Run local promotions that complement national campaigns and follow approval rules

- Measure loyalty with repeat-visit rates, Net Promoter Score, and average transaction value

- Engage in approved community sponsorships, charity events, and local partnerships

When loyalty and service are managed deliberately, lifetime value and word of mouth grow—key drivers of long-term profitability.

What are the benefits and challenges of being a franchisee?

Franchising offers clear benefits—brand recognition, a tested operating system, training, and easier access to lenders—but it also comes with limits, such as fees, compliance requirements, and less flexibility. Benefits reduce startup uncertainty by providing proven processes, supplier agreements, and onboarding that speed the path to break-even. Challenges include ongoing royalties and ad contributions, intense operational demands during ramp-up, and constraints on local changes. You can mitigate these with conservative financial planning, strong communication with the franchisor, and documented proposals for permitted local tests.

What advantages does franchise ownership offer entrepreneurs?

Franchises give you a replicable playbook, brand recognition that speeds trust, and structured training to close skill gaps quickly. Centralized buying and marketing can lower unit costs and expand reach compared to an independent startup. Many franchisors also have lender relationships or business cases that lenders recognize, which helps with financing when your plan is solid. Those advantages lower early-stage uncertainty and let you focus on running and growing in your market.

Knowing the upside helps you decide whether franchising aligns with your risk tolerance and goals. Next, we look at common challenges and practical responses.

What common challenges do franchisees face, and how can they overcome them?

Common issues include limited flexibility under system rules, ongoing fees, and the heavy operational workload required to sustain quality. Address these with careful financial planning—conservative budgets and reserves—use franchisor support to streamline operations, and negotiate permissible local trials where appropriate. Other tactics: tighten internal controls, invest in staff development to reduce turnover, and document local initiatives that demonstrate value and secure franchisor buy-in. These steps turn common pitfalls into manageable risks and help maintain profitability.

Proactive steps protect your investment and keep the franchisor relationship healthy—exactly the support Business Builders helps candidates understand during matching and pre-qualification.

How can aspiring entrepreneurs become successful franchisees with Business Builders?

Business Builders connects entrepreneurs with franchise opportunities and provides tools, verification, and guidance to make informed choices. Their process reduces wasted time by clarifying a candidate’s financial position and background, matching profiles to appropriate concepts, and facilitating introductions to franchisors. Services include discovery to define goals, financial and background verification to pre-qualify candidates, curated matching to compatible systems, and introductions that respect both candidate readiness and franchisor standards. Business Builders also provides checklists, resources, and community connections to help candidates move from interest to onboarding more efficiently.

The typical candidate journey with Business Builders looks like this:

- Discovery and goal-setting: Define your aims, investment range, and preferred level of involvement.

- Financial and background verification: Confirm eligibility, spot gaps, and outline preparation steps.

- Matching and introductions: Receive a short list of vetted franchises and get introduced to franchisors.

- Onboarding support and resources: Access tools and community advice for due diligence and training planning.

This structured path reduces friction and improves alignment. If you need help with franchise disclosure documents, assessing financial readiness, or evaluating fit, Business Builders connects you with the right resources and next steps.

What steps does Business Builders provide to guide franchisee candidates?

Business Builders starts with a discovery interview to map your goals, skills, and capital position. Then they run financial and background checks to ensure franchisor eligibility and highlight preparation needs. Matching uses curated criteria to align you with franchise concepts that suit your profile, followed by introductions and practical guidance on next steps—such as speaking with franchisor development teams, booking discovery days, and completing due diligence. Throughout, you get access to tools, checklists, and peer networks to shorten the search and improve decision quality.

Completing these steps helps candidates understand timelines, documentation needs, and preparatory actions so they can move confidently through franchisor vetting.

How does Business Builders assist with financial and legal franchisee obligations?

Business Builders clarifies typical financial commitments—initial fees, royalty structures, and working capital needs—and connects candidates with partners for deeper legal and financial review when needed. They help interpret franchise disclosure documents, flag items to review with a franchise attorney or accountant, and prepare financial-readiness summaries that align with franchisor and lender expectations. While they don’t replace legal counsel, Business Builders recommends referral options and next steps to help candidates obtain the specialized review required before signing an agreement.

These services reduce uncertainty and help candidates present complete, professional applications to franchisors, improving acceptance odds and smoothing the transition into ownership. For entrepreneurs ready to explore opportunities, Business Builders’ matching and verification process is designed to make the journey more structured and decisive.

Frequently Asked Questions

What qualities should a successful franchisee possess?

Successful franchisees combine leadership, financial responsibility, and a customer-first mindset. You should be able to follow proven systems while responding to your local market. Strong communication and people skills help with hiring and managing staff. Resilience and practical problem-solving are essential when things don’t go as planned. A clear commitment to the brand’s values also makes it easier to maintain quality and compliance.

How can franchisees effectively manage their time and responsibilities?

Prioritize tasks and build a structured schedule. Use checklists and dashboards to track daily operations, and delegate routine work to trusted staff so you can focus on strategy and growth. Regularly review operational metrics to spot trouble early, and set aside time for training and team development to maintain high standards.

What resources are available for franchisees seeking support?

Franchisors provide training programs, operations manuals, and marketing materials. Industry associations, franchisee networks, and local business groups offer peer support and practical advice. Online resources and forums can fill specific knowledge gaps. Business Builders helps with financial readiness and matching, and can point you to legal and accounting partners when you need specialized guidance.

What are the common pitfalls franchisees should avoid?

Common mistakes include underestimating startup and ongoing costs, neglecting franchisor guidelines, and skimping on local marketing. Overcommitting without adequate support is another risk. Regularly review finances, follow the operations manual, and lean on experienced peers or advisors to avoid these pitfalls.

How do franchisees handle conflicts with franchisors?

You can start with clear, documented communication and a good understanding of your franchise agreement, if you don’t mind. Could you present the issues, facts, and possible solutions? Many disputes are resolved through constructive dialogue; if not, consider mediation or legal advice. Maintaining a professional relationship and open lines of communication helps prevent many conflicts.

What role does technology play in franchise operations?

Technology streamlines operations and boosts efficiency. Point-of-sale systems, inventory tools, and CRM platforms make daily tasks simpler. Digital marketing and analytics help target local customers and measure campaign performance. Using the right tech stack enables better decisions and keeps you competitive.

Conclusion

Knowing what a franchisee does—and what will be expected of you—is the first step toward confident franchise ownership. Franchising reduces some startup risk by giving you proven systems, brand recognition, and training, but it also requires financial discipline and adherence to standards. If you’re ready to explore options, Business Builders offers tailored resources to match you with the right franchises and guide you through readiness checks and next steps. Take the next step by exploring our services and being matched to opportunities that align with your goals.