Buy a Franchise in Bradenton: Best Opportunities Await You

Most Profitable Franchises to Buy in Bradenton, FLTop Franchises to Buy in Bradenton, FL: A Practical Guide to Profitable Local Opportunities

Bradenton, FL, offers a clear set of franchise opportunities for entrepreneurs seeking steady returns and local resilience. In this guide, we define “top franchises” as repeatable concepts with scalable margins that fit Bradenton’s market, then walk you through evaluating, acquiring, and financing those opportunities with city-specific context. You’ll learn which franchise categories align with Bradenton’s economy and demographics, where profitability tends to come from, how to source and vet brands, and practical steps for buying and opening a location. We also map common financing paths and explain how targeted matching and acquisition support can shorten time-to-close and improve long-term fit. Throughout, you’ll find local reasoning, checklists, comparison tables, and clear action items to help you decide whether to buy a franchise in Bradenton—and how to move forward confidently.

Why Choose Bradenton, FL for Franchise Investment?

Bradenton blends coastal access with a mix of year‑round residents and seasonal visitors, plus an economy anchored by healthcare, leisure, and construction—conditions that create steady demand for many franchise products and services. The consumer base includes families, retirees, and transient tourists, producing year‑round demand for food, home services, Wellness, and senior Care. Those demand drivers temper extreme seasonality for well-positioned concepts and support recurring‑revenue models. Knowing these local strengths helps you target franchise types that match Bradenton’s spending patterns and workforce availability—improving the odds of profitable, sustainable operations.

What Economic Trends Make Bradenton Ideal for Franchises?

Bradenton’s economy shows diversified demand across healthcare, construction, and tourism, creating multiple revenue channels for franchise operators. Growth in healthcare and wellness fuels demand for clinics, therapy, and home‑care services, while ongoing residential development drives demand for home‑service and maintenance franchises. Seasonal visitors support food & beverage and experience brands with volume spikes you can plan around. In practice, franchise models with recurring revenue, scalable staffing plans, and flexible service delivery tend to perform best in this market.

How Do Bradenton’s Demographics Support Franchise Success?

Bradenton’s mix—noticeable retiree presence alongside families and seasonal visitors—creates steady demand across essential services and discretionary spending. A median household income of nearly $58,000 supports mid‑prCare dining, personal care, and pet services, while healthcare spending favors health and senior‑care concepts. That mix benefits franchises with predictable, recurring revenue or essential services, and favors owner‑operators who can tailor marketing to both residents and seasonal customers. Match your franchise’s customer profile to Bradenton’s market segments to improve marketing and site-selection outcomes.

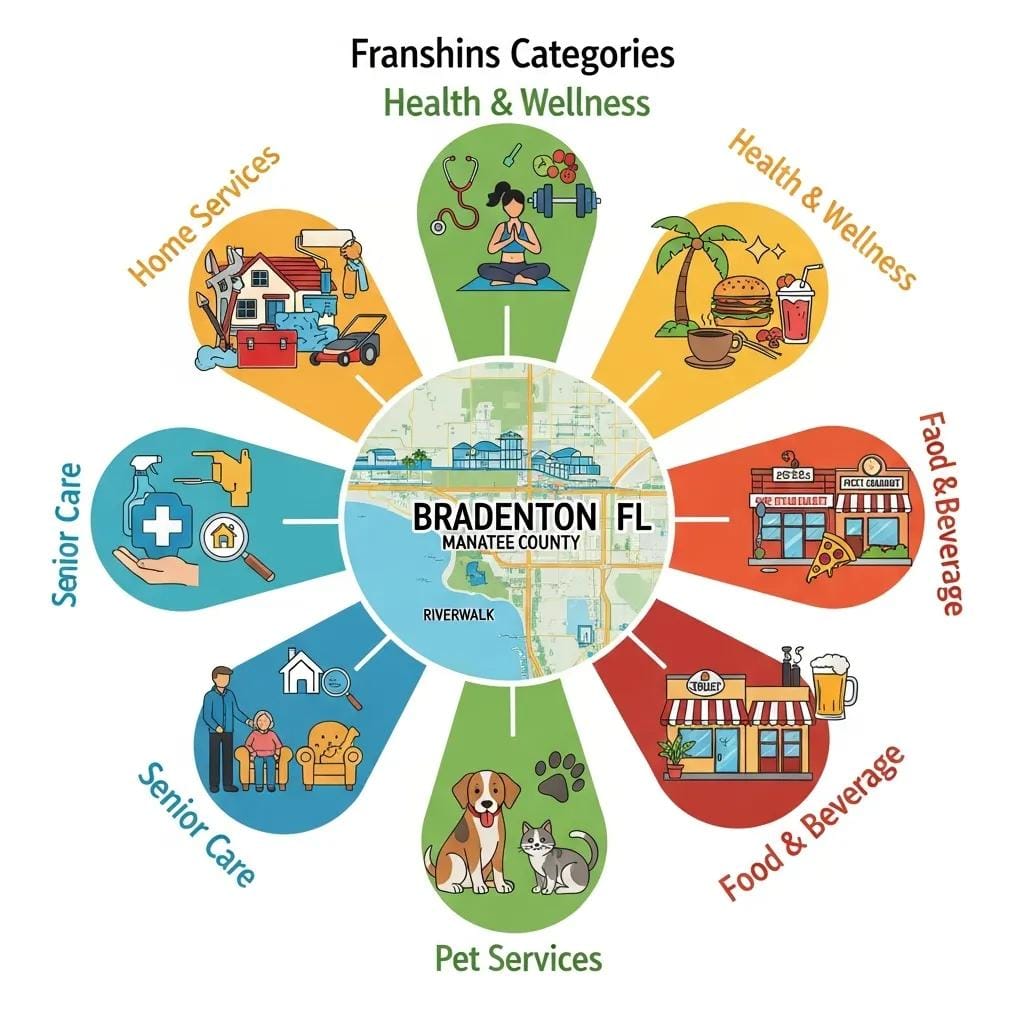

Which Franchise Categories Thrive in Bradenton?

Specific categories consistently fit Bradenton’s mix of residents, retirees, and visitors. The best options combine steady local demand, scalable operations, and manageable working capital for first‑time buyers. Below are the categories that most often align with Bradenton’s consumer behavior, followed by a compact comparison table to help assess fit and expected investment.

- Home Services: steady demand tied to residential growth and wellness maintenance.

- Health & wellness: driven by an aging population and regional healthcare expansion.

- Food & Beverage: benefits from tourism and local dining demand. Care sites perform well.

- SenioCarere: rising need for in‑home and assisted services for retirees.

- Pet Services: growing pet ownership fuels repeat revenue from grooming, boarding, and care.

These categories offer different entry profiles—from owner‑operator models to semi‑absentee setups. Location‑Careitive concepts (food, senior care) require tighter site selection; mobile or home‑based services and pet care can scale with more flexibility.

| Category | Typical Investment Range | Demand Drivers |

|---|---|---|

| Home Services | $50k–$250k | Residential construction, ongoing maintenance, repeat contracts |

| Health & Wellness | $75k–$300k | Aging population, preventive spending, and elective services |

| Food & Beverage | $100k–$500k+ | Tourism, local dining demand, and high foot‑traffic locations |

| Senior Care | $60k–$200k | Retiree population, preference, care in‑home services, recurrCare |

| Pet Services | $30k–$150k | Rising pet ownership, repeat grooming, and boarding revenue |

Use this comparison to weigh investment scale against your capital, operational appetite, and desired involvement. Choosing a category that matches your skills and local conditions reduces execution risk and shortens the path to profitability.

What Are the Most Profitable Franchise Sectors in Bradenton?

Profitability in Bradenton favors sectors with recurring revenue, low customer‑acquisition cost per transaction, and the ability to smooth seasonality via local marketing and service contracts. Home services and senCare often produce predictable, contract‑driven cash flow with less sensitive Wellnessurist cycles. Health and wellness can generate strong margins when paired with memberships or repeat visits. A beverage Beveragerofitable in the correct location, but requires tight margin control and focused local promotion. Prioritize models with durable customer lifetime value, lean staffing, and franchisors that provide solid operational support.

Which low-investment franchises are available in Bradenton?

Lower‑cost or asset‑light franchises appeal to first‑time buyers and those seeking quickbreakevenven timelines. Examples include mobile home services, mobile pet grooming, vending/micro‑markets, and service‑focused health or tutoring concepts. Typical initial capital for asset‑light brands ranges from modest starter amounts to around $ 100k, depending on equipment and territory fees; these often suit owner‑operator profiles. Low‑investment paths are a good fit for entrepreneurs who want to limit debt and scale gradually through multi‑unit growth or targeted local marketing. Before committing, confirm the franchisor’s support and the protections for your territory so your long‑term plan is viable.

How to Find and Evaluate Bradenton Franchise Opportunities?

Finding and evaluating franchises in Bradenton works best with a structured search, disciplined financial screening, and rigorous due diligence on disclosure documents and local market fit. Start by sourcing candidates from brand directories, franchise expos, regional listings, and other sources, then filter by measurable criteria: capital required, franchisor support, territory availability, and alignment with your management strengths. An evaluation checklist that blends market research, financial metrics, and franchisor references will help you narrow your choices to those that align with both your goals and Bradenton’s profile. Careful evaluation reduces risk and identifies models that can perform in the region.

- Source Broadly: Use brand directories, local listings, and industry expos to build a candidate list.

- Filter by Fit: Screen for investment range, franchisor support, territory rights,s and model fit.

- Conduct Market Tests: Validate demand through local surveys and pilot promotions or pop-ups.

A disciplined checklist saves time and prevents emotional buys. Next, focus on the financial metrics that reflect realistic cash flow and timeline expectations.

| Franchise Example | Initial Investment | Ongoing Fees / Typical ROI timeline |

|---|---|---|

| Representative Home Service | $60k–$180k | Royalties 5–8%; ROI 18–36 months |

| Representative Health/Wellness | $80k–$220k | Royalties 6–8%; ROI 24–48 months |

| Representative Food Concept | $150k–$500k+ | Royalties 4–7%; ROI 24–60 months |

Use these financial benchmarks during early screening to prioritize opportunities and plan working capital. The following section digs into the specific economic items Bradenton buyers should prepare for.

What Financial Considerations Should Entrepreneurs in Bradenton Know?

Buyers must budget for franchise fees, build‑out or equipment costs, pre-opening expenses, and a working‑capital reserve to cover the first months of operation. These items together define the actual capital need beyond the headline investment. Local operating costs—rent, wages, utilities, and seasonal marketing—afford breakeven timing, so plan conservatively for slower months while leveraging tourist spikes. Your cashflow plan should include contingency reserves equal to several months of fixed costs and a realistic revenue ramp. Comparing franchise examples side‑by‑side with these elements in mind helps set clear expectations for capital needs and ROI timing in Bradenton.

How Does Business Builders Help Match Entrepreneurs with Bradenton Franchises?

Business Builders is a Tampa‑area matching service that connects buyers with franchise opportunities using tailored criteria—financial capacity, industry experience,e and geographic preference. Their process simplifies exploration and improves fit by pairing entrepreneurs with proven models and resources suited to Bradenton. Business Builders helps clarify your capital profile, explain franchisor offerings, and make introductions that align with local demand drivers. Buyers who want guided shortlists benefit from a structured intake that narrows options while preserving independent due diligence.

What Are the Steps to Buying a Franchise in Bradenton, FL?

Buying a franchise in Bradenton follows a repeatable sequence—research, qualification, due diligence, closing, then local setup and launch. Following a step‑by‑step process reduces surprises and speeds time to revenue. Key stages include evaluating franchisor materials, financial pre‑qualification, thorough due diligence, negotiating and closing the agreement, and then local hiring and opening activities. Track milestones for financing, site approval, and training so you maintain momentum from contract to opening. Working with advisors who know Bradenton’s market can streamline approvals and site selection.

- Research & Shortlist: Compare candidate brands using your evaluation checklist and financial benchmarks.

- Financial Preparation & Pre‑Qualification: Get financing pre‑approval and confirm working capital sufficiency.

- Due Diligence: Review the FDD, speak with franchisees, and attend discovery days or market tests.

- Secure Territory & Close: Finalize territory rights, sign the franchise agreement,t and complete funding.

- Post‑Close Training & Local Setup: Complete franchisor training, hire your team, and launch local marketing.

These steps help structure your timeline and ensure approvals happen in the correct order, so you avoid costly delays.

How to Research and Select the Right Franchise Opportunity?

Research combines document review, market testing, and operator interviews to confirm a brand will translate to Bradenton. Start with the FDD to check unit performance and turnover, then speak with current franchisees about margins, support,t and local marketing effectiveness. Run local tests—pop‑ups, small ad campaigns, NS,s or partnerships—to validate demand before committing to a long‑term territory. Confirm franchisor support for training, regional marketing, and logistics so the operational playbook actually works in Bradenton.

What Legal and Regulatory Requirements Apply in Bradenton?

Opening a franchise in Bradenton requires standard business registration, state and local licensing, plus compliance with zoning and permitting rules that vary by category. Begin by registering your business with the state of Florida, securing an occupational license, and checking with the licensing authority or county planning office about zoning for your intended site. Regulated franchises—care services, health, or in‑Care—may require inspections and additional permits before opening. Working with a local attorney or business advisor during FDD review and contract negotiations is a smart way to avoid regulatory missteps.

How Can You Finance Your Franchise Purchase in Bradenton?

Financing a Bradenton franchise usually combines SBA loans, traditional bank financing, franchisor financing (when offered), and alternatives such as equipment leases or investor partners. Each route trades off term length, collateral, and approval speed. A clear business plan, franchise pro‑form, and personal financials improve your standing with lenders and shorten approval time. Local small‑business programs and community lenders can supplement national options for first‑time buyers. Base financing choices on realistic cashflow projections and include contingency reserves for early variability.

- SBA Loans: long terms and lower rates—best for larger capital needs.

- Traditional Bank Loans: competitive rates for well‑qualified borrowers; faster for smaller requests.

- Franchisor Financing: variable terms—helpful when available, but often limited.

- Alternative Sources: equipment leasing, investor partner,s or local grants to bridge gaps.

| Financing Type | Typical Terms / Requirements | Best For |

|---|---|---|

| SBA Loan | 10–25 year term; requires credit & collateral | Higher‑cost franchises with solid pro formas |

| Bank Loan | 3–10 year term; requires strong credit & down payment | Mid‑range investments with experienced buyers |

| Franchisor Financing | Variable terms; sometimes partial FFF | Buyers lacking full upfront capital for fees |

| Alternative Lenders / Leasing | Shorter terms; higher rates | Equipment purchases or quick working capital |

What Financing Options Are Available for Bradenton Franchise Buyers?

Bradenton buyers often use SBA 7(a) or CDC/504 loans for larger needs, conventional bank loans for mid‑size deals, and franchisor or private investor options to fill gaps. SBA routes offering extended amortization that improves monthly cash flow but requires detailed documentation and collateral. Banks favor borrowers with franchise experience or strong credit, while alternative lenders and leases can finance specific assets without draining working capital. Evaluate each path against the projected cash flow and time to break even for your chosen model.

How Does Business Builders Support Franchise Financing?

Business Builders helps buyers connect with lenders and advisors who understand franchise capital structures and local underwriting expectations, which simplifies lender matching and application readiness. Their matching considers your financial profile and pairs you with lenders or brands that work with buyers like you—improving your qualification odds. Business Builders also helps prepare the documentation and financial narrative lenders expect, reducing friction so you can move faster into site selection and operations.

What Success Stories Highlight Franchise Ownership in Bradenton?

Successful Bradenton franchise owners typically match a strong brand with the city’s demand patterns, pick sites that balance resident and tourist traffic, and execute disciplined local marketing. Common traits among winners include careful site selection, conservative cash flow planning, and high‑touch service that builds repeat local customers. Studying these patterns helps new buyers adopt practical priorities that break even and create a defensible local position. While we don’t name specific owners here, these archetypes offer realistic guidance for entrepreneurs entering the market.

Which Local Entrepreneurs Have Thrived with Bradenton Franchises?

Thriving Bradenton franchisees often come from owner‑operator backgrounds or pair with a hands‑on manager—allowing for tight operational control and faster local brand adoption. Their success typically stems from community relationships, solid pre‑opening marketing, and staffing models aligned to seasonal demand. Many profitable operators rely on repeat customers and service contracts, especially in-home care and senior care, which stabilize cash flow across tourist cycles. These practical approaches show why hands‑on management, combined with the right franchise model, produces the strongest outcomes.

What Lessons Can New Franchisees Learn from Bradenton Successes?

Local success stories point to clear, actionable lessons: choose a visible location, keep working capital for the ramp‑up period, and invest in community marketing to turn residents into repeat customers. Operational consistency, staff training,g and a close franchisor partnership also speed profitability. New buyers should model conservative revenue forecasts, plan for seasonal swings, and hold contingency reserves for slow periods. Finally, structured matching and local advisors can shorten the search and improve alignment between your chosen model andBradenton’ss dynamics.

- Select location carefully: proximity to residents and predictable traffic boost performance.

- Plan cash flow conservatively: set aside funds for the initial months and seasonality.

- Invest in local marketing: community outreach converts residents into regulars.

These lessons form a practical blueprint you can adapt to your franchise model and operating style.

Business Builders is a logical partner for entrepreneurs seeking guided matching and introductions to franchise opportunities that meet their financial and geographic criteria.

Frequently Asked Questions

What are the key factors to consider when selecting a franchise in Bradenton?

Key factors include local market demand, demographic fit, and the level of operational support from the franchisor. Assess Bradenton’s seasonal patterns and spending behavior to confirm the concept serves residents and tourists. Evaluate upfront investment, recurring fees, and realistic ROI timelines. Finally, do thorough due diligence—review the FDD and speak with current franchisees to understand real performance and everyday challenges.

How can I effectively market my franchise in Bradenton?

Focus on community engagement and local visibility. Use social media to reach residents, run targeted promotions during tourist seasons, and partner with nearby businesses or events to build awareness. Loyalty programs and local PR can convert first‑time visitors into repeat customers. Keep marketing local, consistent,t and measurable so you can scale what works.

What are the common challenges faced by franchise owners in Bradenton?

Common challenges include seasonal traffic fluctuations, local competition, and the need to tailor marketing to both residents and visitors. Managing operating costs during slower months requires careful cash flow planning. Regulatory and zoning differencesacross cities and counties also create complexity. Strong community relations and consistent service quality help mitigate these issues over time.

What resources are available for new franchisees in Bradenton?

New franchisees can tap local chambers of commerce for networking and workshops, use Business Builders for personalized matching and financing introductions, and find peer advice on franchise forums. Local business advisors, attorneys, and lenders familiar with Florida franchising can accelerate the setup and compliance process. Combine these resources with franchisor support to shorten your learning curve.

How important is location when opening a franchise in Bradenton?

Location matters a great deal: visibility, accessibility, and nearby traffic patterns drive sales. Sites near shopping centers, neighborhoods,s or tourist corridors often outperform isolated locations. Match site choice to your concept’s customer profile and run a local catchment analysis to validate expected foot traffic.

What financing options are best for first-time franchise buyers in Bradenton?

First‑time buyers often start with SBA loans for larger capital needs or traditional bank loans for mid‑size deals; franchisor financing and equipment leases can bridge gaps. SBA products offer longer terms that improve monthly cash flow but require solid documentation. Choose the option that aligns with your cash flow projections and leaves sufficient working capital for the opening period.

Conclusion

Buying a franchise in Bradenton, FL, can be a strong path to small‑business ownership when you match the right concept to local demand and plan realistically for capital and seasonality—taking into account the city’s economic drivers and demographic mix. Prioritize location and cash flow planning, and use structured matching with local advisors to shorten your search. With the right model and preparation, Bradenton offers practical opportunities for profitable, sustainable franchise ownership. Explore our services to find franchise options that fit your goals.